Flipkart is a popular e-commerce platform in India, where users can purchase a wide variety of products online. One of the features of the platform is the ability to download invoices for purchased items.

In this article, we will explain the step-by-step process for downloading invoices from Flipkart.

Steps to Download Invoice from Flipkart

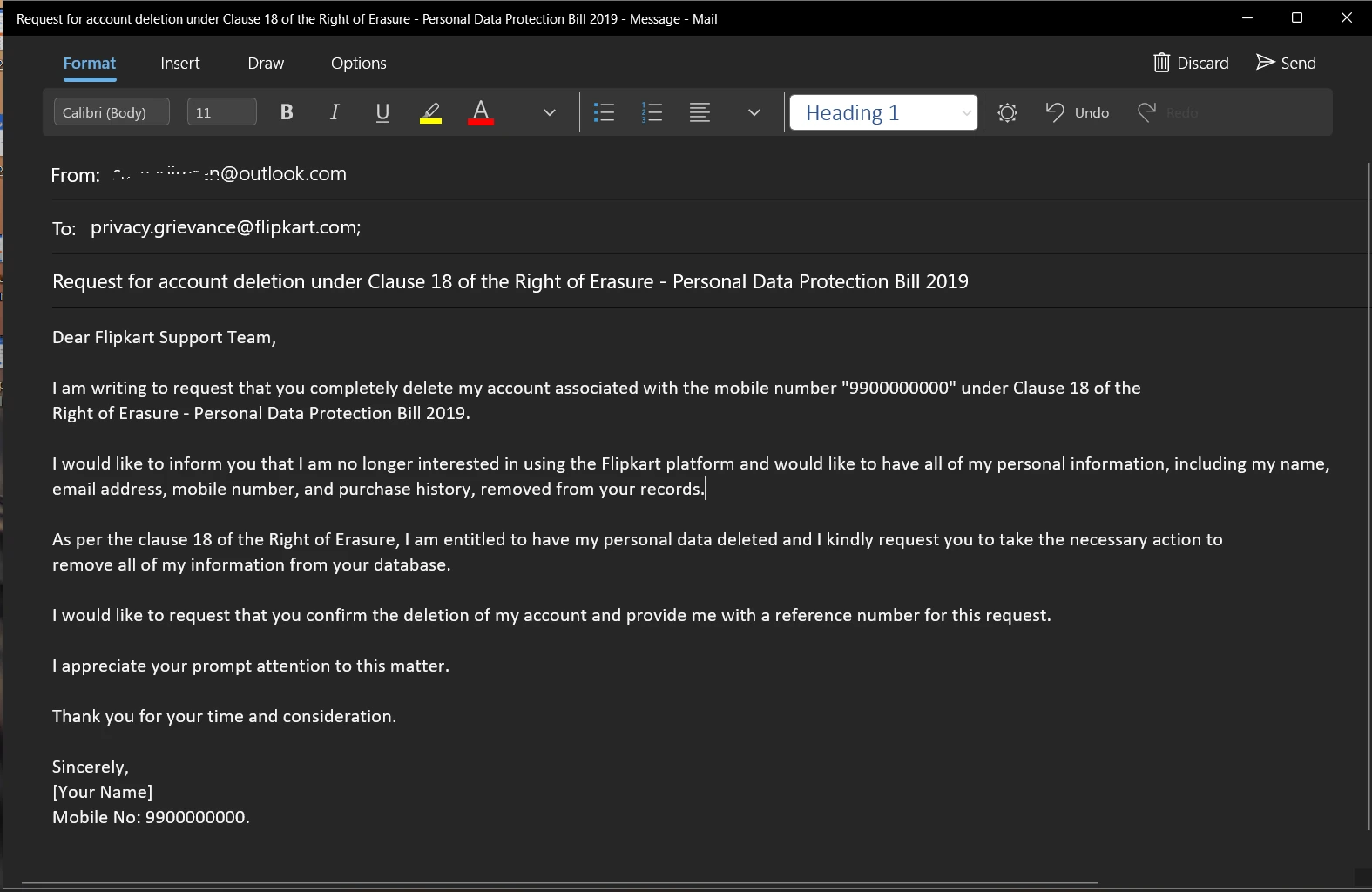

Step 1: Log in to your Flipkart account To begin, log in to your Flipkart account using your registered mobile number or email address.

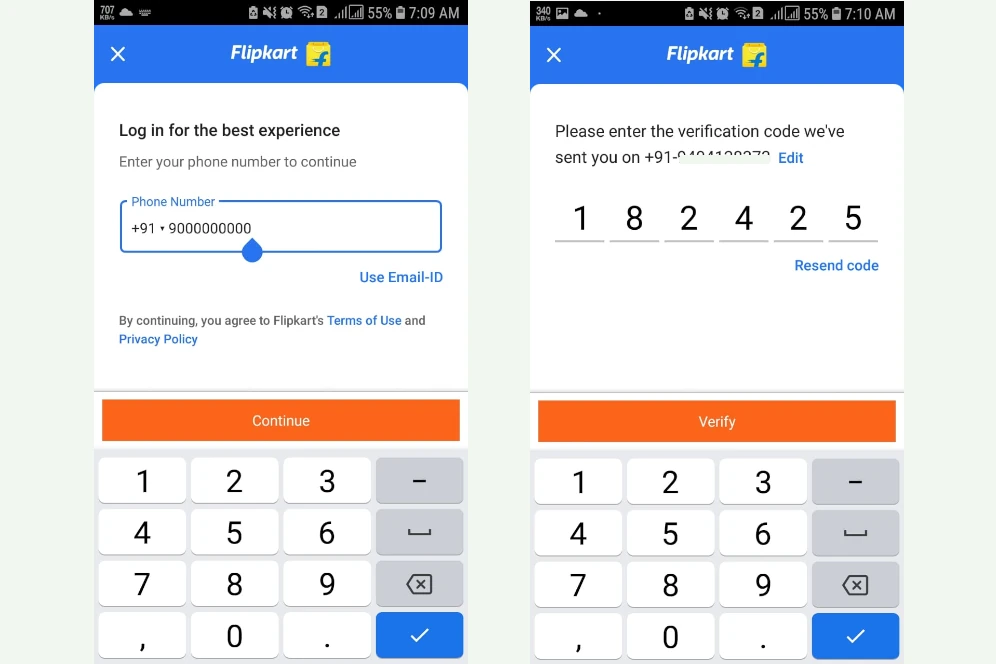

Step 2: Go to your Orders Once you are logged in, you will be taken to the homepage. Click on the “Orders” tab, located on the top right corner of the page. This will take you to a page where you can view your past and current orders.

Step 3: Select the Order Click on the order for which you want to download the invoice. This will take you to the order details page.

Step 4: Download the Invoice On the order details page, you will find the option to download the invoice. Click on the “Download Invoice” button. The invoice will be downloaded in PDF format and will contain all the necessary details such as the order number, date of purchase, and a list of items purchased.

Step 5: Print or Save the Invoice Once the invoice has been downloaded, you can either print it or save it for future reference.

It is that simple, by following these five steps, you can easily download invoices from Flipkart. This can be useful for keeping track of your purchases and for any returns or refunds that may be needed in the future.

Why invoice downloaded from Flipkart is important

An invoice downloaded from Flipkart is important for several reasons:

- Record-keeping: An invoice serves as a formal document that records the details of a transaction, such as the date of purchase, the items purchased, and the total amount paid. This information can be useful for keeping track of your expenses and for budgeting purposes.

- Returns and refunds: If you need to return or exchange an item, the invoice serves as proof of purchase and is required by Flipkart for processing the return or exchange.

- Warranty and Insurance: Having an invoice can be helpful in case you need to make a claim under the warranty or insurance of a product. Many warranty and insurance providers require an invoice as proof of purchase.

- Tax purposes: Depending on the country you are located, the invoice can be used for tax purposes, such as claiming a GST credit.

- Legal evidence: In case of any legal disputes, an invoice can serve as evidence of a transaction and can be used in court.

Overall, an invoice is an important document that serves as a record of a transaction and can be useful in a variety of situations. It’s a good idea to download and keep track of invoices for all your online purchases.